In forex trading, just like in every other kind of trading, the sad truth is that most traders lose money. Looking at long-term results, around 95% of forex traders are taking a hit. They’re not just failing to make a profit. They’re losing money.

But what if you could somehow use that to your advantage? Imagine if you could go back in time and do things differently. Turn that losing short trade into a winning long? You could be turning the kryptonite of everyone’s trading nightmares into pure gold! Just think of it.

Well, that’s the whole idea of reverse trading.

But hang on for a second right there. Before we get carried away, I want to make sure we’re all clear on one thing. Making reverse trading work is no easy feat, so please don’t go into it thinking this is a way to get rich quickly. Think of this as a valuable method to know and a new tool in your forex toolkit. Don’t think of it as a trick that will put you on the Forbes list overnight.

Okay, with that disclaimer out of the way, I want to explain how you can make reverse trading work.

What is Reverse Trading?

How can you make a consistently bad trader work in your favor?

Let’s say you have a friend who’s a very unlucky trader and loses money with every trade. Wouldn’t it be great if you could do the exact opposite – flip every trade they make on its head – and make money every time? Of course, it would, but we all know it can’t be that simple.

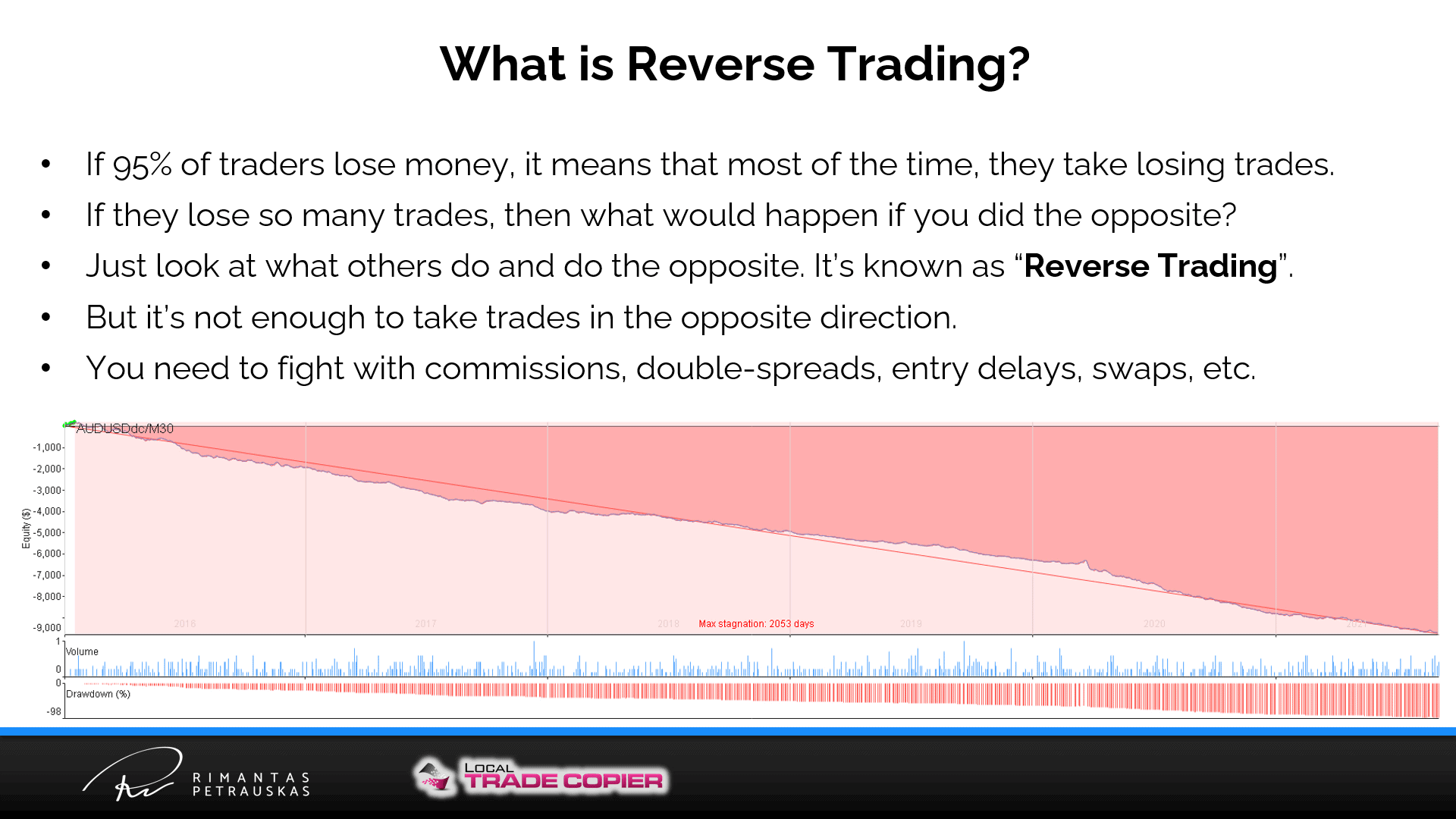

First, you have to get over the hurdle of commissions, double spreads, entry delays, etc. Take a look at this first graph. It shows a backtest of a strategy losing money over five years.

But if you can’t get a mirror image of a losing trading strategy, what’s the point of reverse trading? You’re still getting an effective trading tool if you can get as close as possible to reflecting the losing trader. There are little dips here and there where it was profitable for a while before it returned to its losing ways. But here’s the important thing. You can’t just reverse this and get a nice steady line headed up in the opposite direction. Firstly, there will be many things breaking up your line, like double spreads and commissions. But also, you can’t just reverse every trade precisely, so you can never get an actual mirror image.

And how can you make this whole thing work, make all the tweaks to the system you need, and even automate the entire operation? Guys, let me introduce you to my FAIL 2 GAIN™ Framework below. It is one of 5 secret ways to increase your Forex profits on MT4 and MT5.

The FAIL 2 GAIN™ Framework

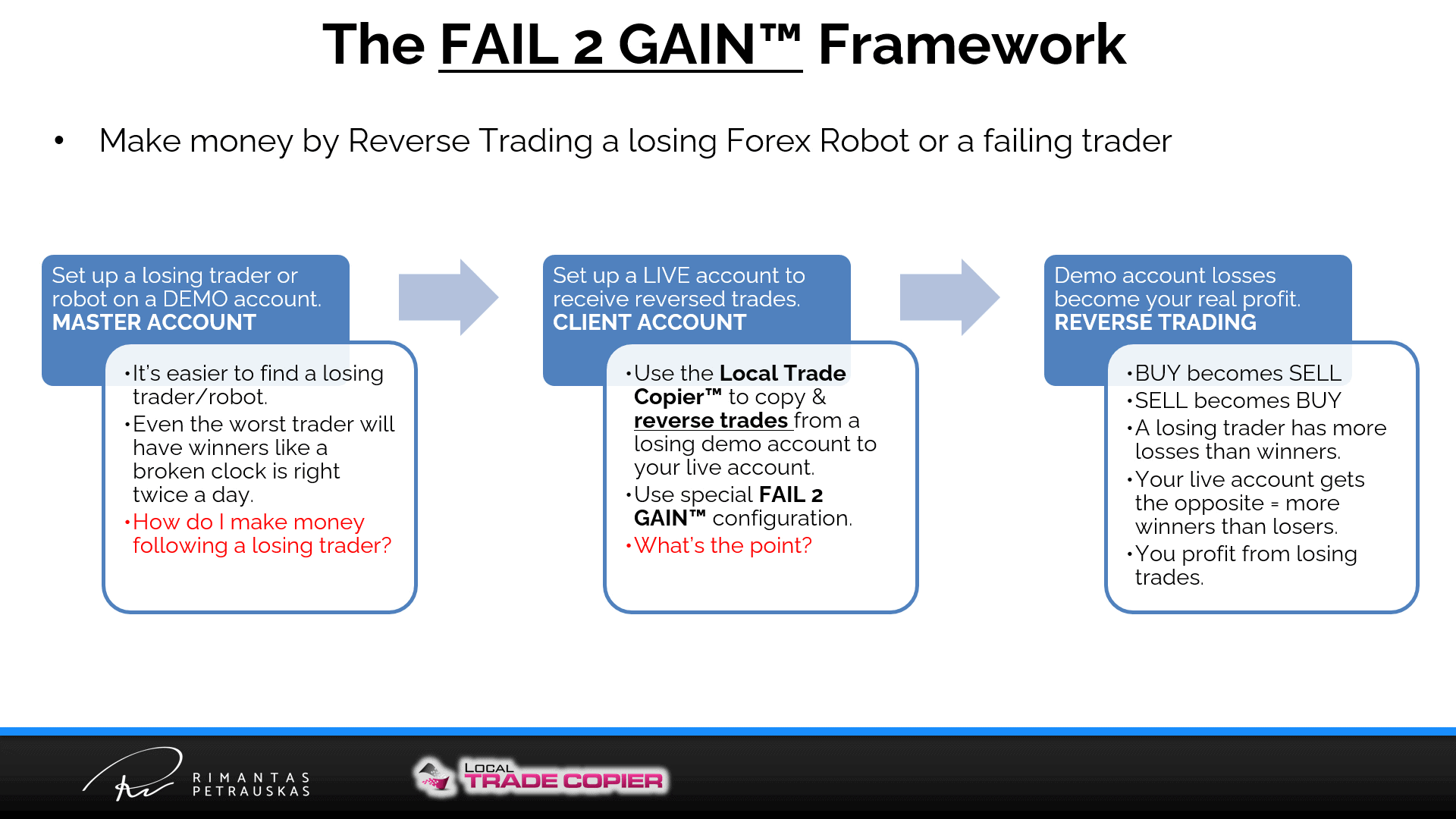

Fail 2 Gain™ is a framework for turning around a losing forex robot or a failing trader who is mostly picking the wrong trades.

So I’m looking forward to explaining how this works because it’s a neat approach to reverse trading. We’ll look at this through the example of a losing forex robot. I believe that’s the best way to explain the Fail 2 Gain™ framework. Even really terrible human traders will have winners from time to time, and if you’re reversing their trades, those times will always be somehow inconvenient. Instead, it’s better to rely on a robot that’s not picking good trades anymore.

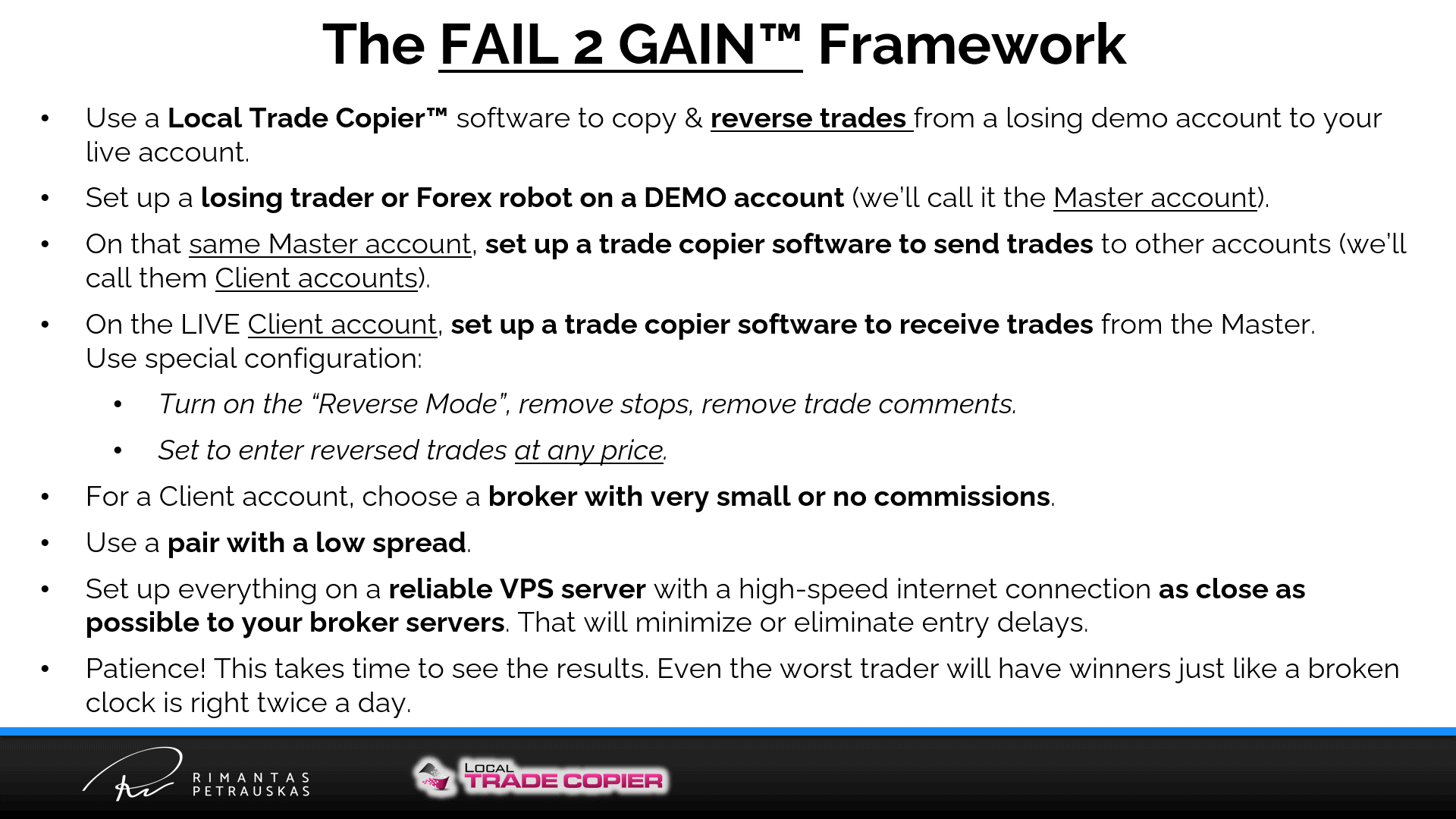

To automate this process, you will need to use the Local Trade Copier software to clone MetaTrader accounts. The first step is to set up the losing forex robot to run on a demo account, which will be your master account.

Step two is to use the Local Trade Copier software to send out trade signals from this master account to your client accounts. Remember, you can have as many client accounts as you need.

The most important part of this step is to set up the Local Trade Copier software in a special reverse mode. While doing this, you should also remove all the stops and the trade comments. That way, you will hide the comments generated by the master account.

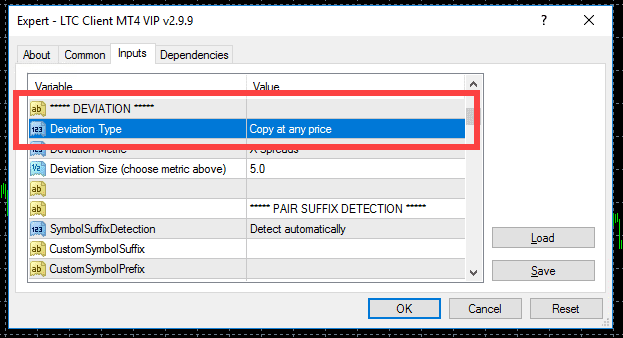

Make sure to set up the Local Trade Copier to enter the reverse trades at any price. Otherwise, the trade copier might miss many trades. The reason for that is the deviation being too large from the open price because of the spread difference. I told you that you would be paying a double spread. So, imagine that your master account is going long. It enters a buy trade at the asking price on the Master, but when you reverse that on the Client, it becomes a sell trade that you take at the bid price. Hopefully, that makes sense. I’m making it as simple as possible.

The spread is automatically incorporated into this trade already. When you close, you’ll have to close at the asking price. That is another spread to pay.

I also advise removing the stops. I know even the thought of this makes most traders get a bit nervous. In reverse trading, the stops get switched. The stop-loss will become a take-profit, and the take-profit will become a stop-loss. That means any sharp price movements will wipe out your trades before you get a chance to make any money. But, if you’re committed to keeping your stops in place, at least make sure you loosen them up by about 20-30 percent.

There are just a couple of other things to remember to do. The first is to choose brokers with low or no commissions for your client accounts. I would recommend Fusion Markets broker. It is to make sure hefty commissions don’t cut into your profits so much that it makes your trades pointless.

The second important thing to remember is to choose a currency pair with a low spread. It’s no good to trade precious metals or CFDs using this method. What you need are pairs like EURUSD or EURGBP and so on.

And the last thing is, I recommend setting all of this up on a VPS server. Try to find a VPS server that is geographically close to your broker’s server because you want to eliminate any delays caused by your internet connection. That is a crucial part of the equation because the more you can eliminate entry delays for your trades, the better this will work.

Okay, once you’ve done all that – and it isn’t exactly rocket science – you’re ready to start running your reverse trading setup. Of course, you’ll need a little patience to begin. No strategy produces instant results. Eventually, if you have everything set up as I described, you will start to see that the robot running trades on your master account is racking up loss after loss. And the Local Trade Copier will translate this into win after win on your client accounts.

Sure, sometimes the robot will accidentally throw out an unfortunate win, but you’re playing the numbers here, and as long as the losses outnumber the wins on the master account, you should see profits on your client accounts.

Your main take-aways here should be that this is a valuable tool, but it isn’t going to make you rich overnight. It takes time before it starts to work.

So to make things even smoother for you, I’ve created a Fail 2 Gain toolkit, which includes a few forex robots that had poorly performed in backtesting.

The Fail 2 Gain Toolkit

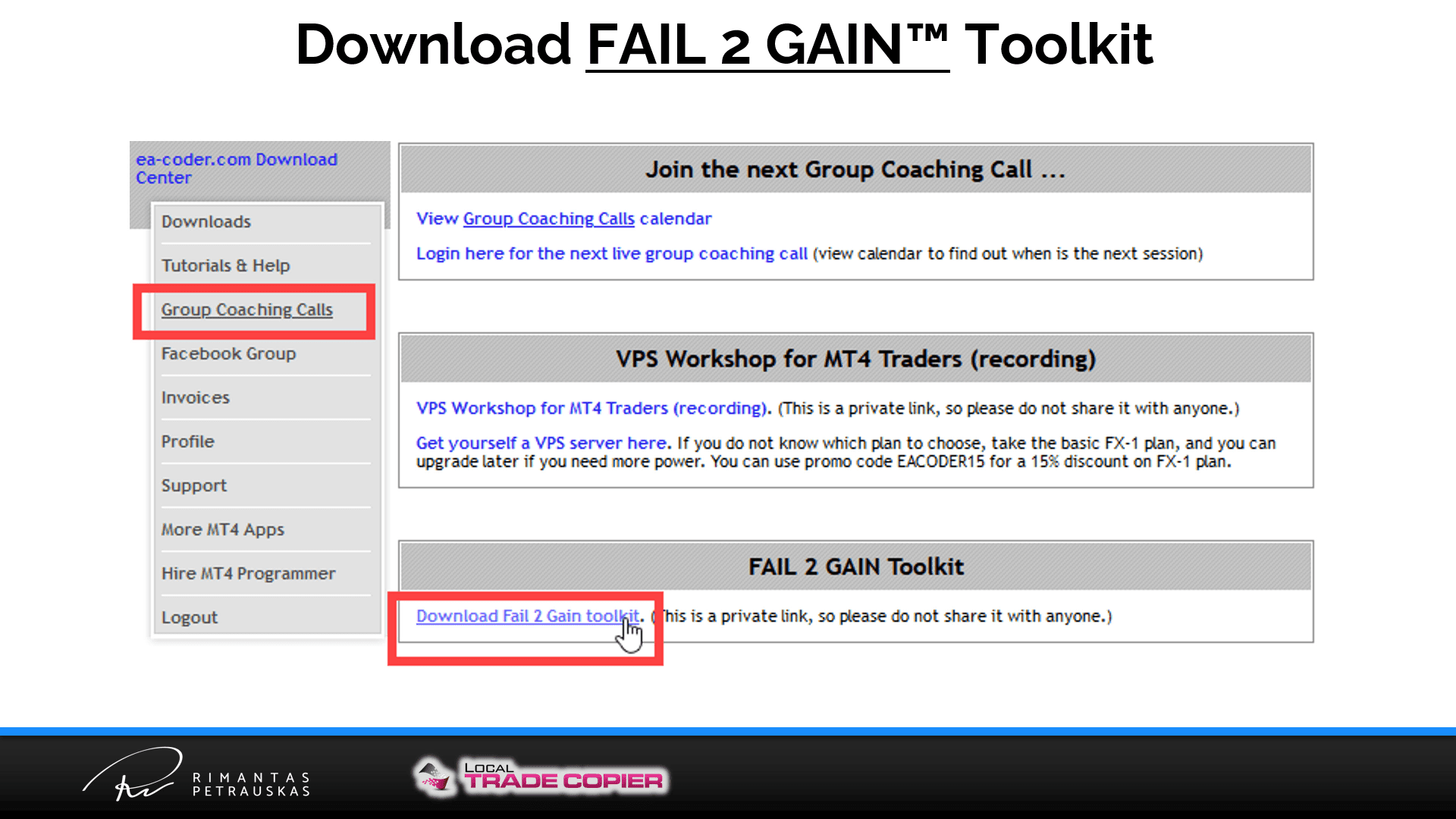

Check out this next screengrab that I made for you. Here you can see how to download the Fail 2 Gain toolkit so that you can start to play around with this and see how to make it work for you.

Everyone who signs up for the MANAGER or VIP plan of the Local Trade Copier™ gets access to the Fail 2 Gain™ toolkit. But keep in mind that even a losing robot could magically become a winning robot in the future. So I want to make sure you know I’m not guaranteeing anything here. I just found a robot that performed badly in backtesting, and I want to share that with you so you can figure out how this works.

To get off the ground with this, you will need this Fail 2 Gain™ toolkit or find your own losing traders or robots you want to reverse. That way, you can start experimenting with reverse trading and start using it.

Let me show you how I set things up for reverse trading and how it could work for you.

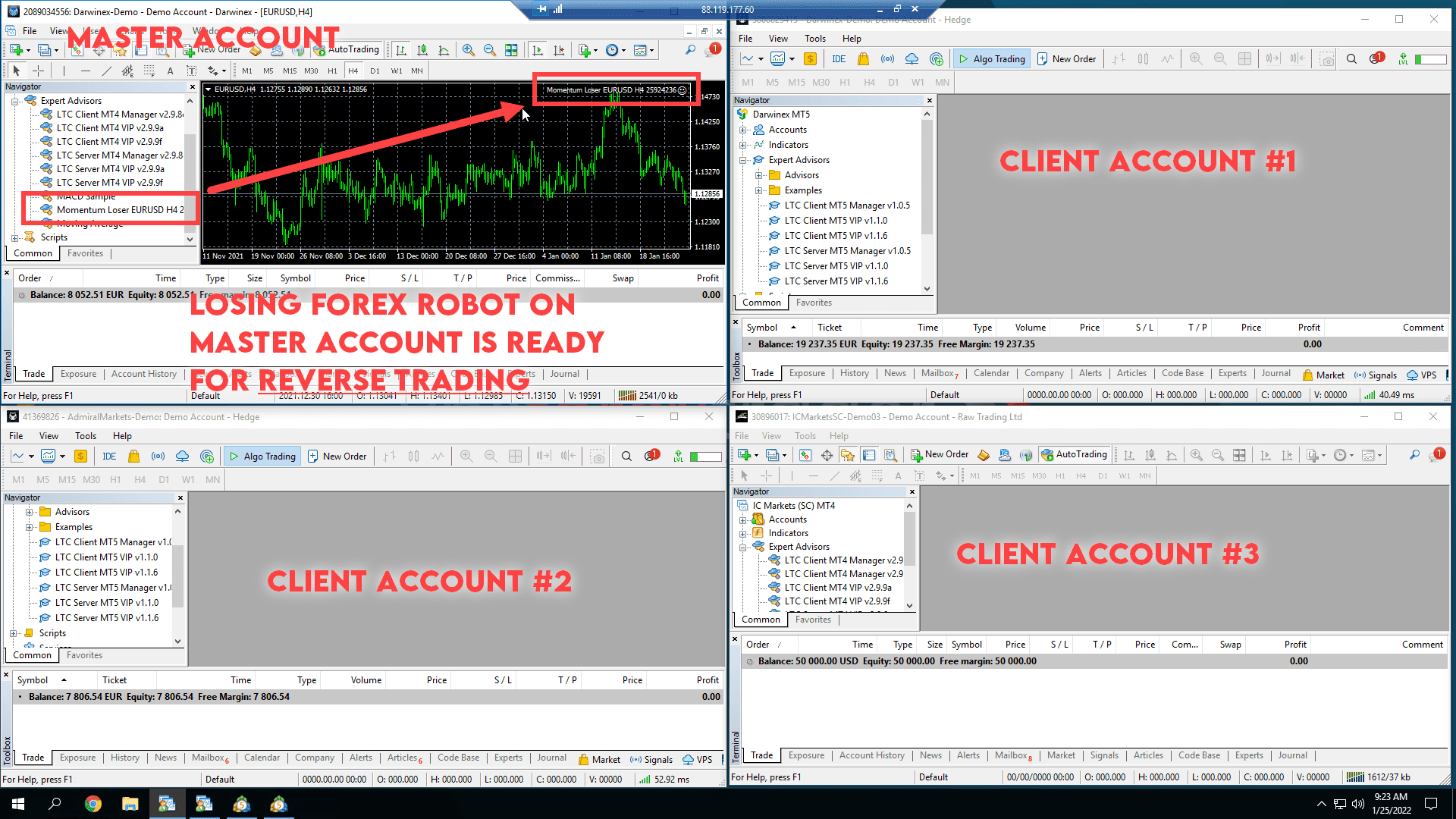

I have a MetaTrader4 account, and I set it up as a Master account. Then I have three client accounts – two MetaTrader 5 accounts set up on Darwinex and Admiral Markets and a MetaTrader 4 account on IC Markets. Remember, these client accounts take their cues from the Master account.

On that Master account, I run the losing robot from the Fail 2 Gain™ toolkit on the 4-hour chart. I set entry lots to micro-lots (0.01) to keep the robot going for as long as possible – even if it loses every day.

I set the stop-loss at 20 pips and the take profit at 20 pips too:

To demonstrate reverse trading immediately, I decided to simulate a trade rather than wait for the robot to generate one on the 4-hour chart.

You can’t run two EAs (Expert Advisors) on one chart on MetaTrader, but you can open a second chart. You can open as many charts as you need (the limit is 100 on Metatrader) and run an EA on every chart. That’s how you can run multiple Expert Advisors on the MetaTrader platform.

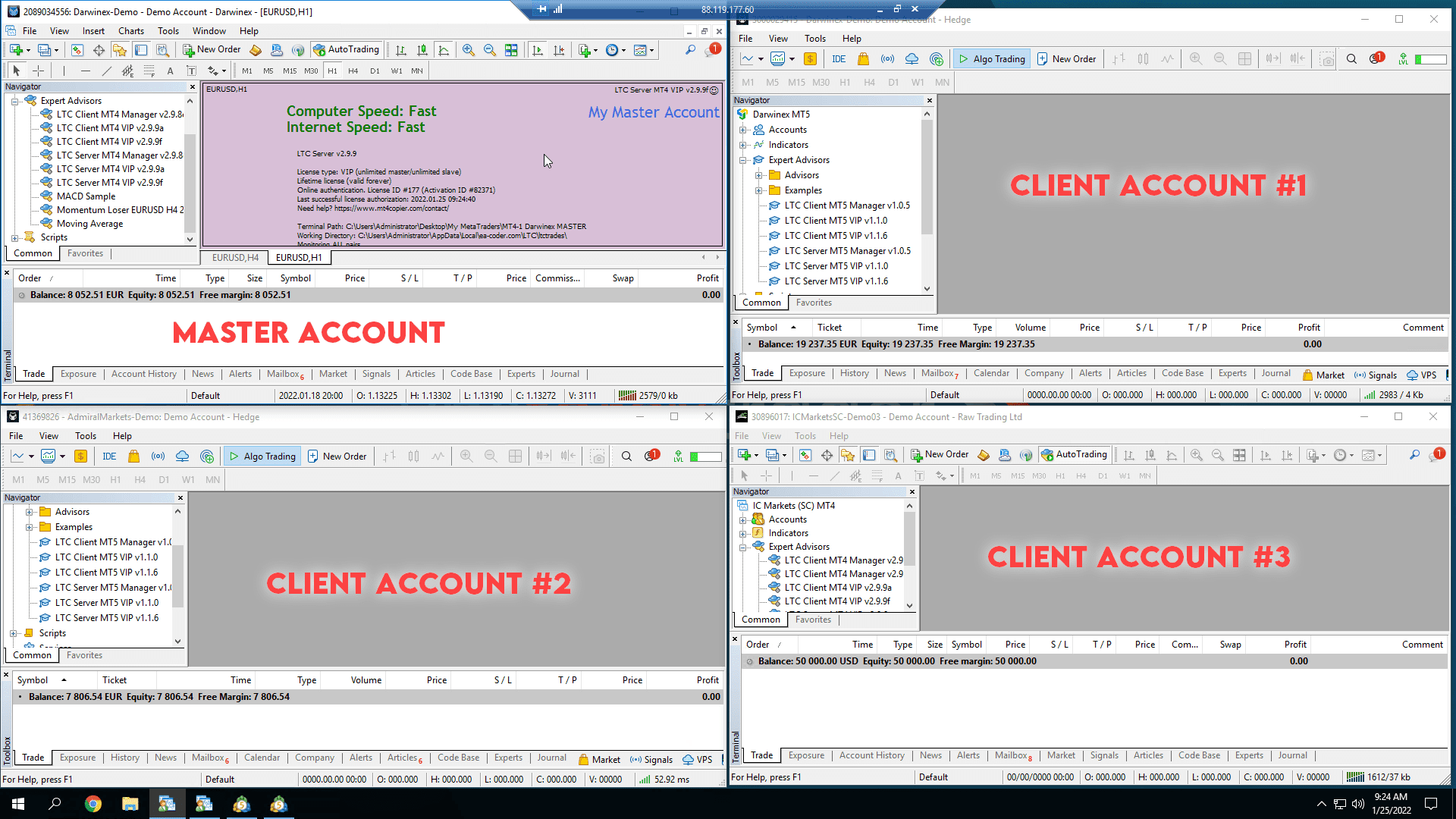

So now, as you can see in the following screenshot, I have set up a Local Trade Copier Server EA on a new chart. I don’t need to play around with the settings, so I’ll leave the defaults.

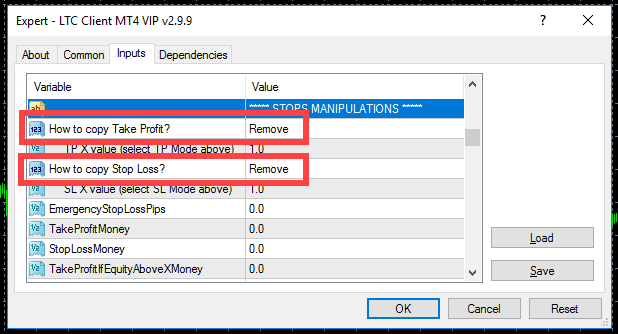

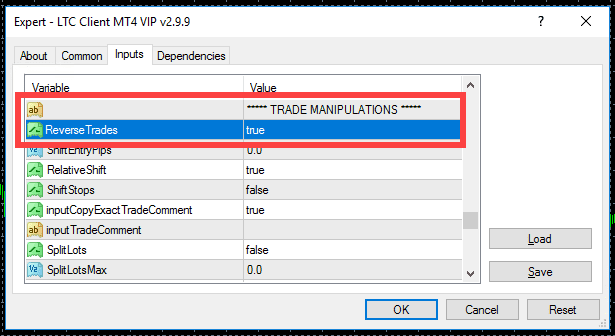

The next step is to set up Client EAs on the three Client Accounts. As I mentioned earlier, we need to set the “deviation type” to “copy at any price”. And to take out all the stops on trades copied from the Master account.

You can see how I did all this in the next two screengrabs:

Now, let’s activate reverse trading on the Client EA.

Don’t get confused by all of the other settings you see here. Just scroll through the settings until you find the “Reverse Trades” variable – you’ll find it under the “TRADE MANIPULATIONS” section.

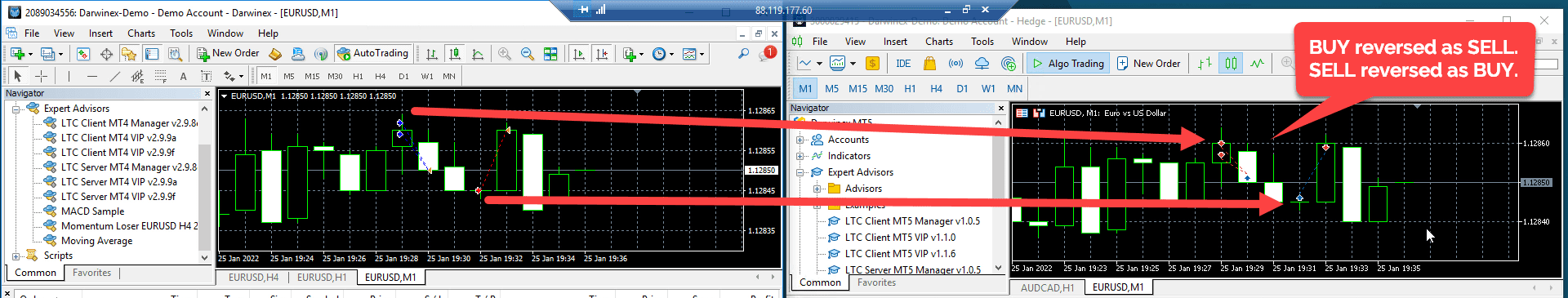

Just activate “Reverse Trades”, and now every SELL becomes a BUY, and every BUY becomes a SELL.

If you don’t want your clients to know what Forex robot you’re using through your master account, you can disable the “copy exact trade comment” function. It makes for a more pleasant and discreet relationship with your clients and friends. They don’t need to know absolutely everything, do they?

So, once you’ve done that, that’s it. You’re ready to go.

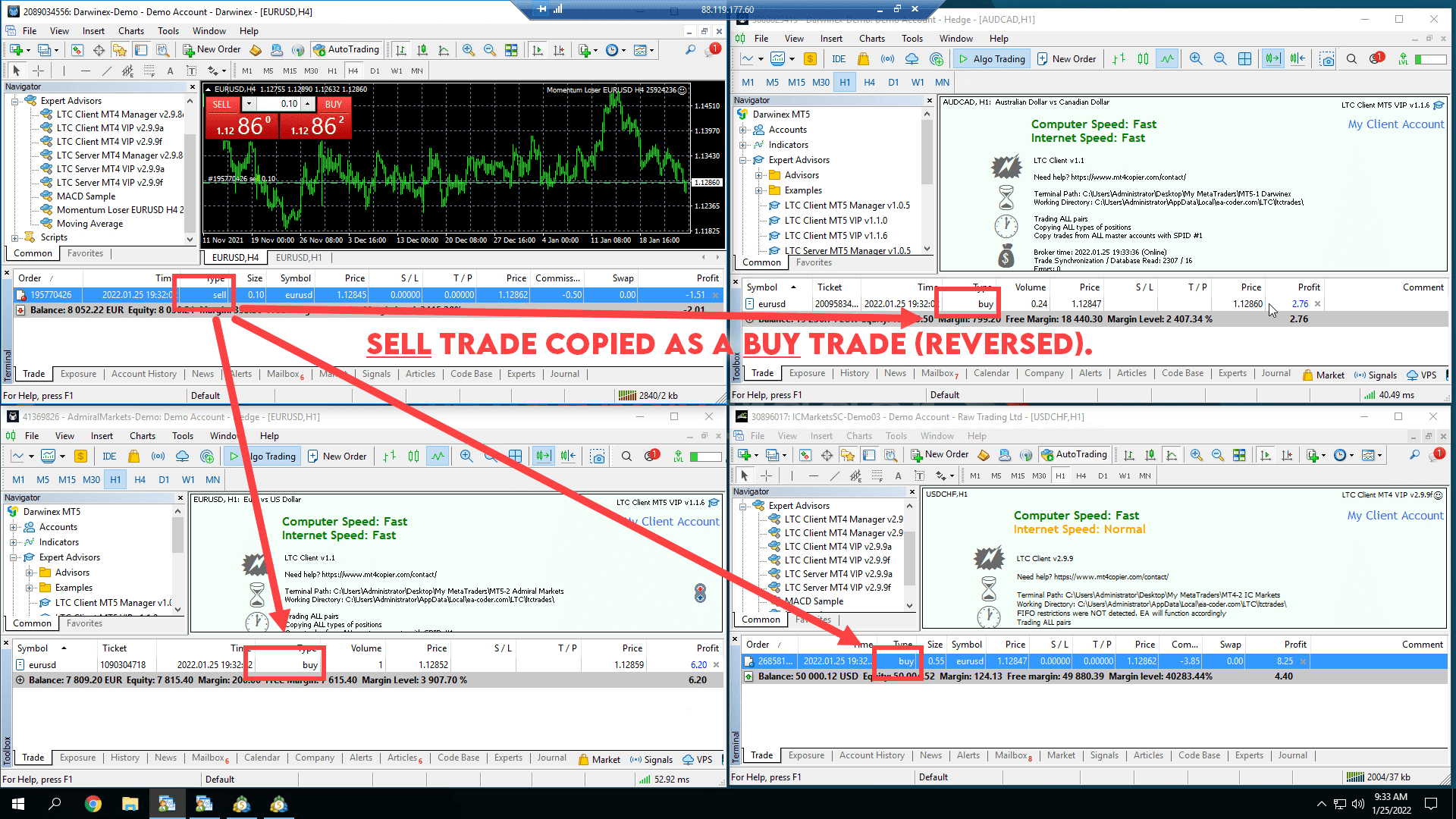

Now let’s open a SELL trade on the Master account and see how all client accounts copy it as a BUY trade.

You can see that the sell trade I ran is immediately copied across as a buy trade to all three client accounts. More than that, the lot size is automatically chosen according to the size of each account. The exception, in this case, was the Admiral Markets account, where I set a fixed lot size of one lot. But the point is that the Local Trade Copier™ software will give you complete control over the lot sizes through its money management settings.

The sell trade on the Master goes into a loss. Meanwhile, the buy trade on Client accounts is heading towards a profit. It doesn’t happen instantly because you need to wait for it to clear the spread. Just like when you enter a manual trade regularly, you need to wait for it to clear the small loss because of the spread. It’s the same story here.

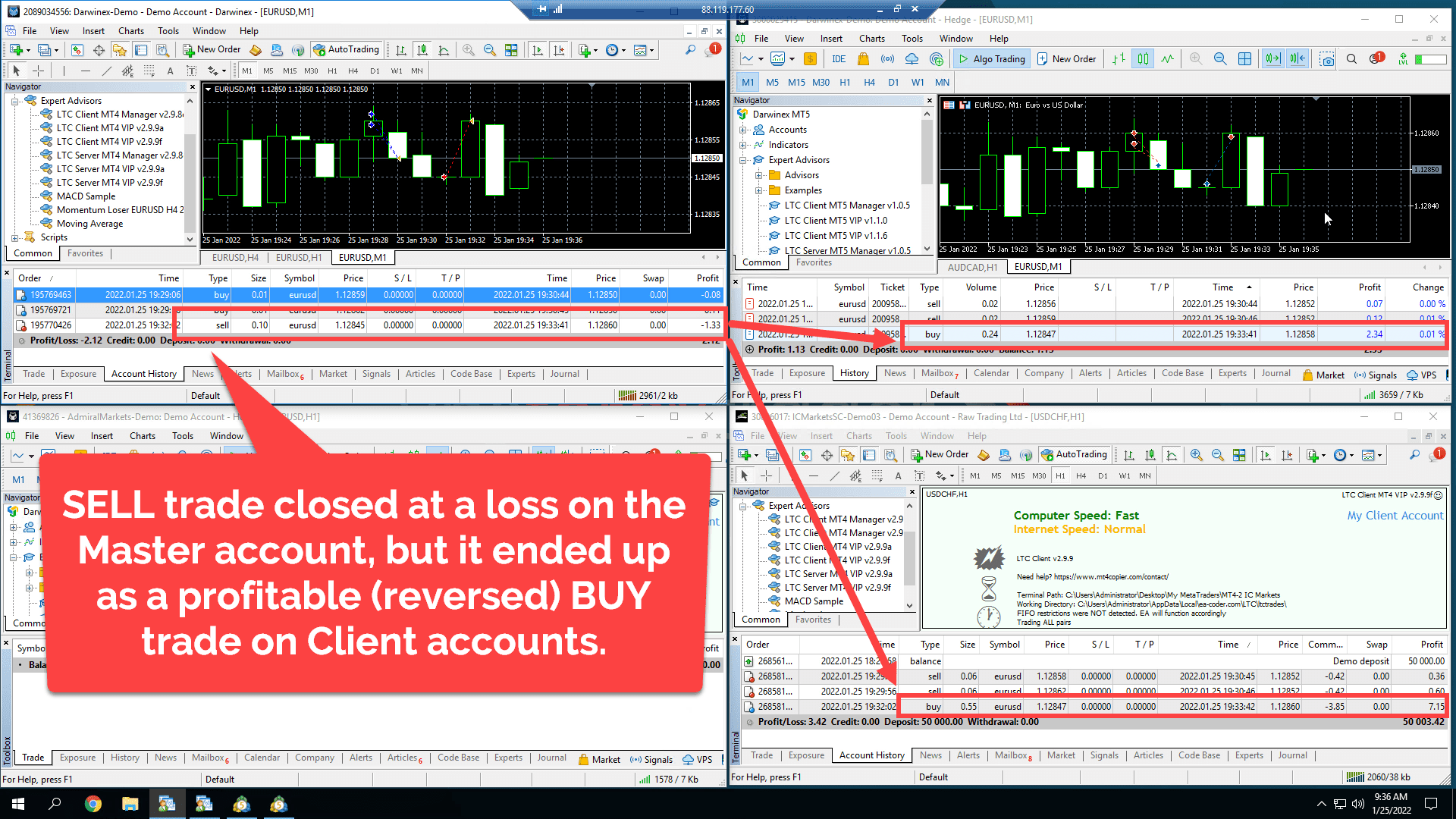

Okay, so once the reversed trade has cleared the spread on the client accounts, it can start to become profitable. If I close the Master trade now and look at the account history, I can see that it is a loss of -$1.33. But when you look at Client accounts, that same trade (but reversed) has made a few bucks.

However, you have to be careful because brokers are always there waiting for their cut. Some brokers charge commission on trades but offer you low spreads, while others don’t charge commission but get their slice of the pie through deeper spreads. You need to weigh up what works better for you based on the sizes of your client accounts. Make sure you choose your brokers carefully to keep them from taking too much of your profits on these smaller wins. In other words, experiment and play around to see how everything works and what the best deals are.

Before you head off to start honing your strategy, here’s one last screengrab to see how this trade looks on a chart.

You can see that this was a really quick scalping trade, and you probably already know that those are more vulnerable to trade entry delays and the spreads or commissions set by brokers. The main thing for me is that you know the risks of this strategy before you commit.

Hopefully, from what I’ve just told you, you’ll have an excellent overview of reverse trading and how useful it can be. Also, you will now know just how to set it up to a level where you can start experimenting with your reverse trading strategies. So, what are you waiting for? Get out there and start testing the Fail 2 Gain™ toolkit and make it work for you!

Hi,

when using reverse copy trade, Id like to know if there an option to;

– reverse copy trade will execute at the client side, only after server side has started to loose trades

Thank you.

Regards,

Zul

Yes, you can set the Client EA to copy the trades only when the Master starts losing trades. You can do that with the help of the MAAB Trade Filter (with the reverse logic) which is available for MANAGER and VIP plans.

What is the price of this reverse trading kit?

You cannot buy a reverse trading kit because it is not for sale. But you will get it as a bonus when you subscribe to the MANAGER or VIP plan.

Would also willing to know whether it works on deriv platform.(synthetic indices like Volatility index, step index etc)

Yes, Local Trade Copier works on Deriv. We have many users using it on Deriv MT5.

When closing a trade will the reverse linked account close as well?

Yes, of course. But if you want a reversed trade to keep running, there is an option to configure this as well.

How much MANAGER or VIP plan.