Local Trade Copier can increase or decrease the lot size of the next order if previous trade closed in a loss when Martingale Mode is enabled. Note that this is a very risky trading style so be sure you know what you are doing.

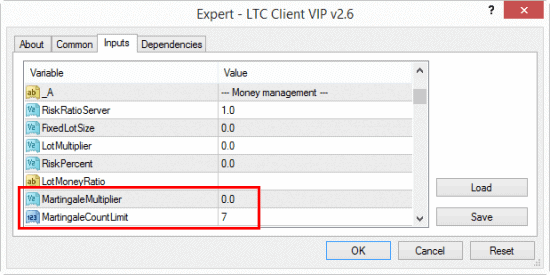

Martingale trading mode options in the Client EA of the Local Trade Copier app for the MT4 client terminal.

Here’s how instruction manual explains these options.

MartingaleMultiplier and MartingaleCountLimit – these options allow you to set the Client EA to apply martingale lot sizing before each trade is copied. By default, a multiplier is set to zero and it means this feature is disabled. Once you set this value to anything above zero the Client EA will start working in “Martingale mode”.

Count limit number is set to 7 by default, but you can change that as you wish. Zero value means there is no limit and EA will apply martingale until there is not enough margin in your account, which I do not recommend. Default count limit of 7 means that if you start with the 0.01 lot size eventually the largest lot size you can get is 1.28 (when using a multiplier of 2).

Here’s how this whole thing works. Before copying a new trade the Client EA will always check the last closed trade’s profit for that particular instrument (currency pair). If the trade was closed in profit the Client EA will calculate a lot size according to your risk option, but if the trade was closed in loss (and the number of last closed consecutive loss trades does not exceed count limit) the Client EA will multiply that last closed trade’s lot size by the MartingaleMultiplier value. Note that the MaxLotSizeAllowed and IgnoreTooBigLotSizeTrades options can be used with this martingale feature as well.

Important to mention that this feature will check only last closed trades on the same currency pair in question and this is how it will determine if the next lot size should be multiplied or not. If you run multiple trades on the same currency pair this option might not work properly because it would be impossible to know which trade’s lot size should be multiplied. So when using this option you should note that it works properly only for those trading strategies that have no more than one trade per instrument.

Example: Say we have MartingaleMultiplier=2 and the last trade of 0.2 lot size was closed in a loss. When a new trade signal will be received here’s how the Client EA will calculate the lot size for this new trade: 0.2 x 2 = 0.4. If this trade closes in loss then the next trade size will be 0.4 x 2 = 0.8 and this will repeat until a trade closes in profit or the MartingaleCountLimit is reached. Once a trade closes in profit or the limit of losing positions is reached the cycle will restart.

Hello,

Can we set up a way for opening postions in child account based on percentage of master acccount equity?

example if master account equity is 10000 USD, master acccunt opens a position like USD JPY for 10 lots,

will it open the same position in child account with 1 lot?

Yes with default risk management setting called riskRatioServer copier will calculate lot size for each client based on difference between account balance. So if you open a 10lot position on a 10000 account it will open 1lot on 1000usd account

other risk parameters are also available

Here is a video where all risk parameters are explained:

https://www.mt4copier.com/risk-parameters/

Hope this helps