In the fast-paced world of financial markets, Forex trading has captured the attention of investors and traders alike. The allure of potential profits, coupled with the excitement of navigating currency fluctuations, makes Forex trading an enticing venture. However, amidst the promises of success, it is crucial to understand that Forex trading involves inherent risks. To succeed in this dynamic arena, one must adopt a well-structured Forex trade management strategy that not only maximizes profit potential but also minimizes risk exposure.

Understanding Forex Trading

Forex, short for foreign exchange, is the largest and most liquid financial market globally, where currencies are bought and sold. It operates 24 hours a day, five days a week, providing traders with ample opportunities to participate in the market. The goal of Forex trading is to speculate on the price movements of various currency pairs, aiming to profit from the fluctuations in exchange rates.

The Significance of Forex Trade Management Strategy

The Forex market can be unforgiving, and without a robust trade management strategy, traders may find themselves at the mercy of unpredictable price swings. Forex trade management is the backbone of successful trading, as it empowers traders to make informed decisions, manage risk effectively, and protect their capital.

Setting Clear Objectives

Before diving into the excitement of Forex trading, it is essential to establish clear objectives. Setting realistic profit targets and determining an acceptable level of risk is fundamental. Understanding your risk tolerance will help shape your trade management strategy and prevent emotional decision-making.

Analyzing Market Trends and Indicators

Successful traders understand the significance of technical analysis and fundamental analysis. Technical indicators, such as Moving Averages, Bollinger Bands, and Relative Strength Index (RSI), provide valuable insights into market trends and potential entry and exit points. Meanwhile, keeping an eye on fundamental factors, such as economic indicators and geopolitical events, can further enhance decision-making.

Implementing Proper Risk Management

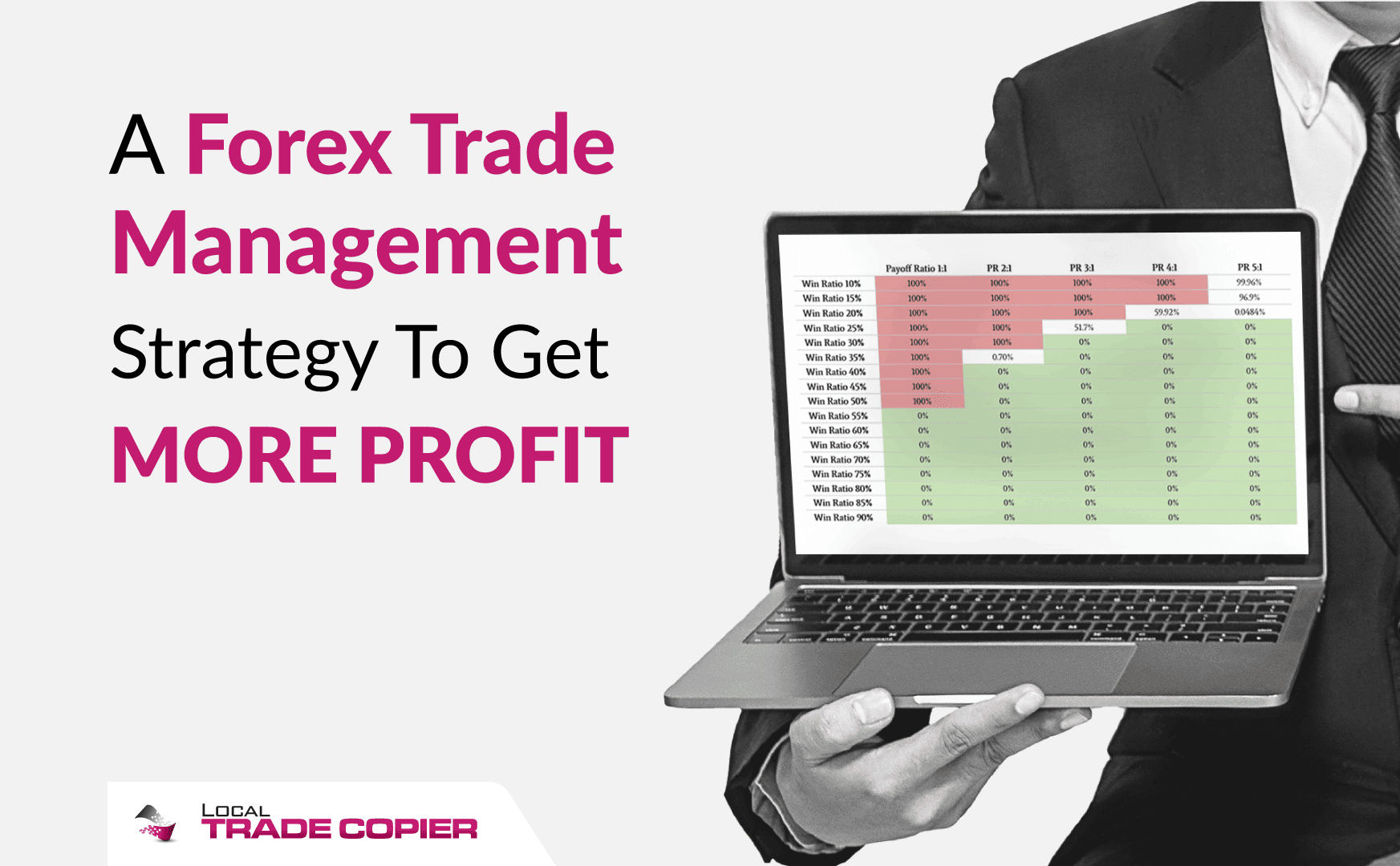

In the world of Forex trading, risk is inevitable. However, how traders manage risk is what sets them apart. A sound trade management strategy involves allocating only a portion of your trading capital to each trade, thus minimizing potential losses.

Using Stop Loss and Take Profit Orders

Two crucial tools in trade management are stop loss and take profit orders. A stop-loss order allows traders to set a predetermined level at which their position will automatically close if the market moves against them. On the other hand, take profit orders lock in profits by closing positions once a specific profit target is reached. These orders help traders maintain discipline and stick to their trading plan.

Employing Trailing Stops

Trailing stops are a dynamic form of stop loss orders that adjust as the trade moves in the trader’s favor. This feature allows traders to protect their gains by locking in profits while still giving the trade room to grow.

Diversification of Trades

The adage “don’t put all your eggs in one basket” rings true in Forex trading as well. Diversifying trades across various currency pairs can help spread risk and increase the chances of finding profitable opportunities.

Managing Emotions in Forex Trading

Emotions can be the downfall of many traders. Fear and greed can lead to irrational decision-making and impulsive actions. Maintaining emotional discipline, staying calm during market fluctuations, and adhering to the trading plan can prevent costly mistakes.

Monitoring and Reviewing Trade Performance

Successful traders regularly monitor and review their trade performance. By analyzing past trades, they can identify strengths and weaknesses in their strategy. This self-analysis enables traders to refine their approach and continually improve their trade management skills.

Staying Informed and Updated

Forex trading is influenced by a myriad of factors, from economic data releases to geopolitical events. Staying informed and updated with the latest news and market developments is vital for making informed decisions.

Maintaining Discipline and Patience

Patience is a virtue in Forex trading. Traders must resist the temptation to chase quick profits and adhere to their trading plan. Discipline and patience allow traders to wait for the right opportunities and avoid impulsive actions.

Conclusion

In conclusion, a well-structured Forex trade management strategy is essential for achieving consistent profitability in the Forex market. By setting clear objectives, analyzing market trends, managing risk, and maintaining emotional discipline, traders can enhance their chances of success. Remember, Forex trading is a journey of continuous learning and adaptation. Embrace the learning process, stay committed to your trade management strategy, and success will follow.

FAQs

1. Is Forex trading suitable for beginners?

Ans. Forex trading can be suitable for beginners, but it requires dedication to learning, practicing, and honing trade management skills.

2. How much capital do I need to start Forex trading?

Ans. The capital required for Forex trading varies based on individual risk tolerance and the trading strategy. It is recommended to start with an amount you can afford to lose.

3. Can I trade Forex on my smartphone?

Ans. Yes, many trading platforms offer mobile apps, allowing traders to access the Forex market on their smartphones.

4. How can I control my emotions while trading Forex?

Ans. Practicing emotional discipline, maintaining a trading journal, and seeking support from fellow traders can help control emotions in Forex trading. It is essential to stay focused on your trading plan and avoid making impulsive decisions.