You may wonder what the heck I am talking about here. Profit from losing positions? YES, you heard me right. When you have a BUY trade that goes down and hits your stop loss you lose money. Every time that happens I bet you wish you could go back in time and open a SELL trade instead. Unfortunately it’s impossible to time travel, well at least I don’t know any method for it and you cannot change your past order from a BUY to a SELL.

But what if you could? Would that help you? What if you could change your BUY trade to a SELL? What if you could turn the stop loss of that BUY trade to a take profit for your SELL trade? You’re probably seeing the benefit of this feature by now but how can you accomplish this without time travel?

If you are looking for a new way to profit in Forex, it is probably likely that you’re not making any money from trading yet. To put it in another way, you are losing money. Now what if tell you that you can reverse all of your losing trades and make money with those reversed positions? Could you make use of a feature that could do that?

Reverse trading is not as easy as it sounds

I don’t want to give you big promises and say that you will make a fortune with this type of trading. Let me just show you the potential of it. Then once you learn how you can do this, you can start experimenting and hopefully find your own secret method of making money in Forex. I know people that have already done this. You can read the story about the losing trader Bob and how his friend is making money from his trading losses.

Reverse trading is basically the same trade copying setup that you’ve already learned about in chapter 5 but this time you will enable reverse trading on the Client EA. This way your trades will be reversed, the BUY positions will become SELL positions and the SELL positions will turn into BUY trades.

Under this mode the Client EA will reverse the pending orders as well. Here is how they will be converted:

- BUY STOP will become SELL LIMIT

- SELL STOP will become BUY LIMIT

- BUY LIMIT will become SELL STOP

- SELL LIMIT will become BUY STOP

As you can see the stop orders become limit orders and the limit orders become stop orders. The trade direction changes as well, pending sell orders turn into pending buy orders and the buys turn into sells.

Roadblocks you will face with reverse trading

The first and the biggest hurdle you’ll face when you try to profit from reversing your trades will be the Spread. Yep, that small price difference between the Bid and the Ask prices makes the implementation of this trading style a lot harder. That is why i recommend using a broker that has small spreads. It is also obvious that the EURUSD pair is the best pair to start off with, since it has the lowest spread.

Let me now explain why the spread may kill your profits. For example let’s say that you have a BUY trade at 1.2200 and on another account you reverse this trade. Now the LTC will open a SELL trade at the same time but you will not get the same price as the BUY trade because of the spread.

If you have a spread of 2 pips you will get a SELL trade opened at 1.2198. Let’s now assume that the BUY trade has a stop loss of 20 pips and a take profit of 20 pips. The values for the SL and the TP will also be affected due to the spread.

Let’s get a bit deeper with the numbers. For example’s sake let’s assume that we have a BUY trade at 1.2200 with a stop loss at 1.2180 and a take profit at 1.2220. A reversed trade of the BUY would be a SELL trade at 1.2198, with a take profit at 1.2180 and a stop loss at 1.2220 (notice how the SL and TP switch places).

As you probably already noticed, the take profit for the SELL trade is smaller by 2 pips, making it 18 pips instead of the 20 pips seen with the BUY trade. We have a similar situation with the stop loss, only here the stop is bigger by 2 pips when compared with the original trade, not smaller. The total for the stop loss comes to 22 pips.

How does this affect your trade? When you make 20 pips profit with the BUY trade, you experience a 22 pips loss with your SELL trade. And if you lose 20 pips with the BUY trade, you gain 18 pips with the SELL trade. In other words, under the reverse trading mode, when you lose you lose more and when you win you win less.

This is what makes reverse trading difficult. But it is still possible and the solution here is to use a bigger stop loss and a smaller take profit level on the initial trade (the master account trade). With these changes you’ll have a bigger take profit and a smaller stop loss for the reversed trade.

Let’s see how this would look like with a BUY trade that has a 100 pips stop loss and a 40 pips take profit. If we reverse the BUY to a SELL on the EURUSD (with spread of 2 pips), we would end up with a take profit of 98 pips and a stop loss of 42 pips. Isn’t this much better?

If you are a bad trader and you lose a lot of 100/40 trades then you will definitely succeed with reverse trading.

HOW TO REVERSE TRADES

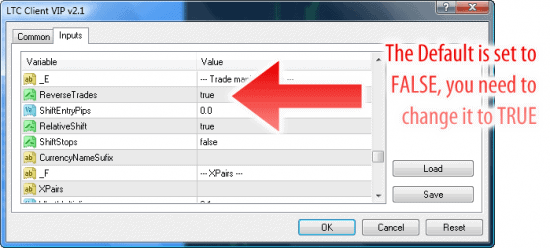

Reversing trades is a simple task. It’s basically the same process as the regular trade copying explained in the chapter 5, but here we need to set the option ReverseTrades=true. That’s pretty much it, nothing special or complicated.

If you don’t have a MT4 platform ready you can learn how to install one by reading chapter 3. In chapter 4 you will find a detailed explanation on how to install the Local Trade Copier software.

There are a few other features in the LTC that could prove to be useful once you get used to this trading style and you need more things to experiment with. For example the Local Trade Copier can swap the stop loss and take profit values for more advanced scenarios. You can also use one of the stop manipulation options available in the Client EA and the Server EA.

For example, you may want to set the SL and TP multiplier to 1.5 or 2.0 on the Client EA in order to have the reversed SL/TP values bigger. This is useful in cases where your SL may get hit on the reversed trade but your TP is not yet hit on the original trade due to price differences between brokers.

I personally like to use a multiplier of 2.0. This makes sure that my reversed trades are closed together with the original trade and not earlier. The Client EA will follow each signal from the server and once a trade is closed on the master account it will be immediately closed on the slave account also.

Tips for reverse trading

If you have Forex robots that constantly lose money you can definitely use them in reverse mode and make money. One issue that you will encounter here is that as your robot continues to lose and drain money from your demo account, at some point you will need to restart the EA on a new account because the old one will be emptied from all the losses.

I remember this one time I haven’t checked my master account for weeks. When I finally checked it, I realized that the EA had stopped trading because there was no money left in the account.

In order to avoid being in that situation again, I opened a new demo account with 100,000 US Dollars and used a 0.1 lot size for my trades. You could also use 0.01 lots instead and this will make your demo account last even longer. The lesson here is to have a bigger master account and use lower lot sizes for its trades. This will make the account balance last longer before there is any need to open a new account.

Another difficulty you may face as you try to implement my suggestion above is that your robot doesn’t use a fixed lot size, it uses account balance to calculate the lot size instead. In this case you may want to program a new feature in your EA so that it is able to trade on a 100,000 account and use only 0.01 as its lot size.

This is pretty easy to implement if you know some MQL4 commands. What you need to do is instead of using the AccountBalance() or AccountEquity() functions in your money management formula, create and use something like OverrideAccountBalance in the external EA inputs. I’ve done this many times and it works great.

I hope that you will find my reverse trading technology useful. I also hope that my ideas and tips on improving your reverse trading campaign will help you make money in Forex. Make sure that you check the next chapter; I have a lot more useful stuff in there.

Now how about some hedge trading?