This is another story that was shared by one of my customers about his friend “Bob”. This time he applies external filter indicators to his trade copying campaign.

Hello readers. Some of you may remember me from an article I wrote about my friend ‘’Bob’’. He was the awful trader that somehow still makes me money? If you still haven’t taken a look, here is the link to part 1 and part 2.

Since the story was published on www.mt4copier.com it generated a great deal of interest and the creator of the Local Trade Copier, Rimantas Petrauskas contacted me and asked me to write another article for his website. He just released the new and improved version 2.1 of his trading software few weeks ago. He asked me to take a look at it and write a review if I find the new features useful in my trading.

There are quite a few improvements over the earlier version, and here are just a couple of them:

- More options have been added, making it possible to further manipulate stop loss and take profit values

- Both the Client and the Server EA can now send an alert when a new trade is opened, copied or closed.

- LTC Manager license now works on up to 2 master accounts and an unlimited number of slave accounts

- LTC Personal license now works on up to 2 slave accounts and an unlimited number of master accounts

Both what really got me excited about the new 2.1 version are the following two new features. They are the reason I decided to do this review and I will go over each of them in a separate articles. The inclusion of the External Trader Filter Indicators for the Client EA is the first big change to happen with version 2.1.

The Local Trade Copier v2.1 is the first account copier for Metatrader 4 that allows for the filtering of trading signals by using external indicators or Global Variables. In layman terms this basically means that you can filter your trades and the trading signals you receive from your trading signal providers based on regular MT4 indicators like the Moving Average or a MACD. This will be the topic of my first article.

The second big change coming with the new version 2.1 is the filtering of trades by time. This is done with the simple drawing of rectangles on the chart and you can add unlimited number of these time based filters to your charts. More about this feature in my second article on LTC version 2.1.

Let us get started and go over the first new feature, External Trader Filter Indicators for the Client EA.

Installing the new LTC version 2.1

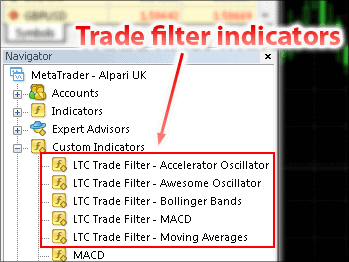

First off, you need to install the new version 2.1. This is again done automatically for you as in the previous version of the software. The indicator will scan your computer for all MetaTrader 4 installations and you just need to pick where you want the Client EA to be installed. The installer will install the latest version of the Client EA together with what will look like your usual MT4 indicators but what are really the so called ‘’trade filter indicators’’.

At the moment, the software comes with 5 trading filter indicators: the Accelerator Oscillator, the Awesome Oscillator, Bollinger Bands, the MACD and the Moving Average indicator. You can find these indicators in the MT4 navigator window, as show on the picture below.

More indicators are planned to be added in the future but you also have the option to create these trade filters yourself if you know your way around programming with MetaTrader 4.

How do you use the trade filter indicators?

The readers probably know my affinity towards trend following. I’m a trend follower, I like to be long if prices move up and short when prices start to move down. This is one of the reasons I am so excited about the new version of the Local Trader Copier. It allows me to filter the trading signals I receive from the signal providers I follow. One of the trade filter indicators I use for this purpose is the Moving Average.

How do you setup the moving average trade filter indicator? The process is relatively simple and easy once you get the hang of it. First you need to start up and configure the Local Trade Copier. If you don’t know how to do this, please refer to part two of my article series about Bob.

Setting up the Moving Average Trade Filter

Once you have the Local Trade Copier set up, we can move to the process of configuring the LTC so that it uses the moving average trade filter.

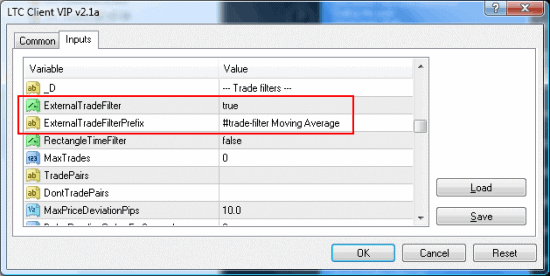

Find the inputs tab in the Local Trade Copier EA, click on it, then scroll down until you see a feature called External Trade Filter. Now you need to switch the default ‘’false’’ value to ExternalTradeFilter=true.

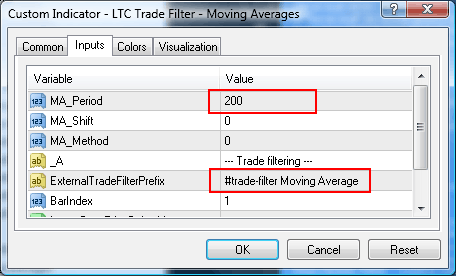

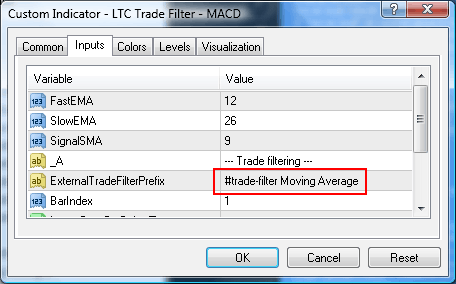

The second step is to make sure that the ExternalTradeFilterPrefix matches the same value as in your external filter indicator settings. We’ll use ‘’#trade-filter Moving Average’’ as our value, exactly as shown on the picture below.

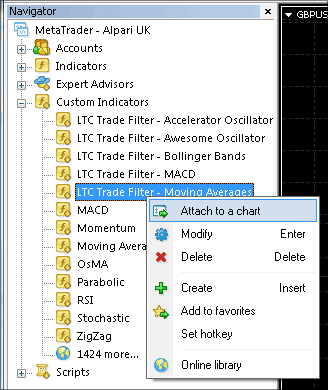

The next step is to setup the moving average trade filter. To do this, go to Custom indicators in your MetaTrader 4 navigator section and locate the indicator called LTC Trade Filter – Moving Averages. You can use one of two ways to place the indicator on the chart, the more elegant way is to right click on the indicator and then choose ‘’attach to a chart’’ as shown below.

The more crude but probably faster way is to just drag and slide the indicator to the chart, same as you would with any regular MT4 indicator.

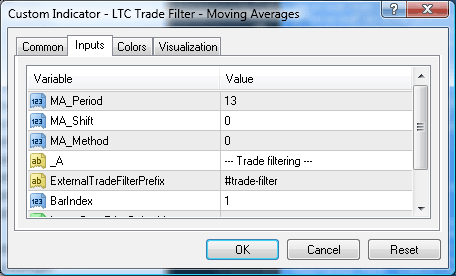

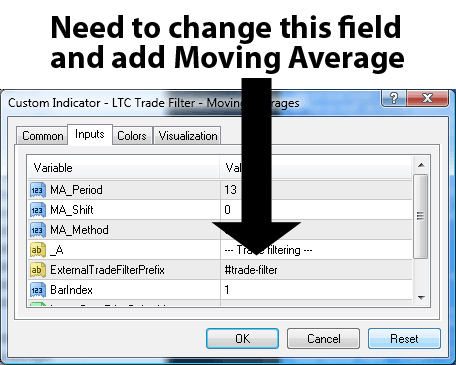

Once you do this, you’ll be presented with the screen below.

Now we need to change the value in the field ExternalTradeFilterPrefix from the default ‘’#trade-filter’’ to match the value we entered earlier in the LTC Client EA: ‘’#trade-filter Moving Average’’.

Because I want the signals that I get from the signal providers to be in agreement with the long term trend, I will also change the default setting of 13 period simple moving average to a 200 period MA.

As you can see on the picture above, the LTC trade filter moving average has the same options as a regular MT4 Moving Average. You can change the shift of the moving average as well as the MA Method, if simple moving averages are not your cup of tea, you can pick an exponential or a weighted moving average.

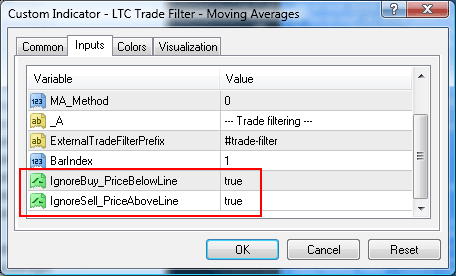

Next you’ll need to scroll down a bit until you see the fields named Ignore Buy – Price Below Line and Ignore Sell – Price Below Line. These options need to stay at their default setting ‘’true’’ in order for the Moving Average filter to work as intended, as shown on the picture below.

When set to true, the trade filter moving average will ignore any buy trades while price is below the 200 simple moving average. And reverse for a sell, the MA will ignore any sell trades while price is above the 200 SMA. Setting the values to false would obviously turn off the filtering capability of the moving average trade filter.

Setting up Multiple Moving Averages

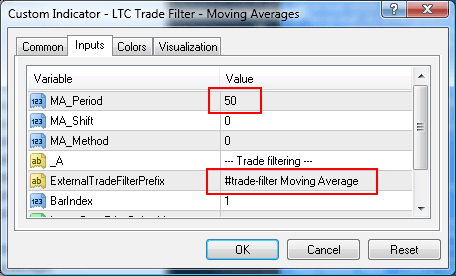

What I needed to do next is add more Moving Averages! The way that I usually use my moving averages is as filters for my entries. I usually scan my charts in the morning and will only take long trades if price is trading above both the 50 and the 200 simple moving average.

As a big believer in price trends and simple moving averages I naturally wanted to find a way to include these indicators as filters for my signal providers too. I needed to find a way to do this, and luckily the latest LTC version turned out to be just the tool I needed for the job!

You can include an unlimited number of indicators as trade filters with the Local Trade Copier. The process to do this is very simple and you basically just need to repeat the steps I outlined above but instead of 200 use 50 as the moving average. The picture below shows the correct way you need to setup the moving average trade filter.

Please again note that the setting in the External Trade Filter Prefix field has to match the initial settings that we used in the Local Trade Copier. In our case we used ‘’#trade-filter Moving Average’’ as the prefix. We have to keep using this handle whenever we include a new trade filter indicator to be used with the Local Trade Copier.

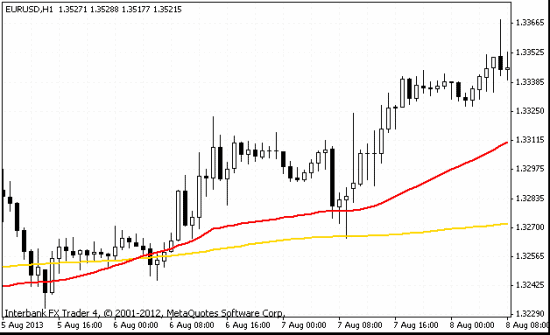

The picture above shows what the moving average trade filters look like once we apply them to the chart. The 50 and 200 simple moving average can both be seen plotted as red lines, the 50 SMA is the one on top while the 200 is the indicator on the bottom.

Summer months cause my systems to falter

As the summer months rolled in I found myself going through some bad drawdowns with my trend following systems. I needed to find out why this was happening. This will probably come as a shock to a lot of you but I managed to figure out that the slow and ranging summer months are a really bad time to trade my trend following system!

All joking aside, after going through my results for the past few years I noticed this consistent slump right in the middle of my account balance each year, it always coincided with the summer months. Naturally I did what any good trader would do in this situation; I stopped trading my system somewhere around the middle of July.

I planned to switch most of my personal account balance towards my trading signal providers and in that way make up for the fact that I would not be making any money this summer with my own trading. But as it turns out, a lot of the trading signal providers that I use were (prepare to be shocked) trend followers themselves! That was precisely the reason why I picked them! As the summer started all of them except one started to also lose money.

Trend following results can be surprisingly consistent across different traders

Trend following is the easiest work in the world when markets are trending but when the ranges set in, you don’t want to be caught dead trading these systems. In addition, trend following results can be surprisingly consistent across different traders. When we make money, we all make money. When we enter a drawdown and start to lose, we all lose.

Just as I was preparing to withdraw all the money from my signal providers accounts and pack in my bags for the summer, I noticed one of the providers was still making money.

Now, I know how I picked my signal providers. I looked for good risk to reward ratios, small losses and large wins. A winning percentage below 50 was also one of the signs that let me know I’m dealing with a trend follower. I checked the stats for the trader that was still making money and sure enough, he had the usual stats like the rest of us, 30 to 40 percent winning ratio and average wins 3 to 4 times the average loss. But there was a difference, this summer he was making money and we were not.

I sent him an email asking him a bunch of questions: how is he making money, did he change his trading system, is he still using trend following, those sorts of questions. He replied that yes he still follows the trend during most of the year but during the summer months he focuses on momentum trading instead.

It’s about the exits not the entry

So that was the reason why he was still making money! He wasn’t trading the trends anymore! The next logical step was to ‘’steal’’ his trading system. Unfortunately he was reluctant to share anything more than the indicator he used for his momentum trading. He just told me: ‘’I use the MACD for entries and after I enter I manage the trade manually, it’s more about the exit then about the entry’’.

He left me with that statement and no clues on how to replicate his trading results. I did a lot of backtesting with the MACD. I tried all sorts of different settings and I actually discovered settings that showed themselves to be superior to the ones suggested by the winning momentum trader.

I tried to trade the system myself. My entries were fine, I could ‘’see’’ how the system should work, but I just couldn’t get the good exits, I kept losing money. I realized that he was right, it was all about the exit. That’s where he was making the money and I was losing it.

I emailed him again and gave him my improved MACD settings. He wrote me a short reply: ‘’Told you focus on exits’’. He didn’t want to look at different settings. Guess I couldn’t blame the guy, after all he was making money, don’t change what works right?

Using the MACD as an External Trade Filter with the LTC

Then it hit me. I thought to myself: What if I use the improved MACD entries as filters for the trading signal provider that was making money? I would setup the indicator to only allow entries that go along with my new and improved MACD settings and reject all other trades he makes. This way I would get the improved entries of the MACD combined with the good exits by the winning trader.

Again the process of setting this up was very easy. Drag the LTC Trade Filter – MACD from your navigator folder to the chart (or simply right click on it and choose attach to chart). You’ll be presented with the screen below.

Now you need to make sure that the field named ‘’External Trade Filter Prefix’’ matches the exact settings that we used in the Local Trade Copier. In our case we used ‘’#trade-filter Moving Average’’ as the prefix, so we need to again use that value. The indicator will work despite the fact that the prefix says ‘’moving average’’ and not ‘’MACD’’. You can put any name for the trade prefix that you wish, the name is not important. The important thing is that the value has to match the name you used for the prefix previously, when you were setting up the Local Trade Copier.

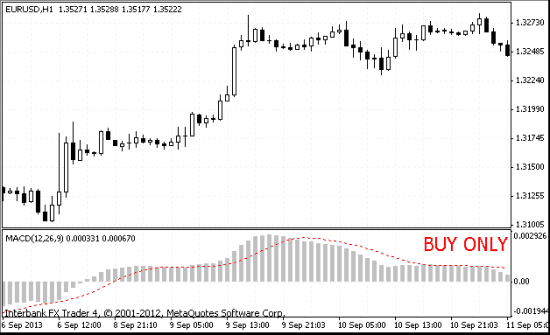

The picture above shows how the MACD looks once you apply it to the chart. Notice the big read letters ‘’BUY ONLY’’ in the corner of the indicator. Because the MACD is currently above 0, only buy trades will be copied to the account. Any sells sent by the trading signal provider will be automatically rejected.

I hope that sharing my experience with the new and improved Local Trade Copier version 2.1 was useful. Good luck and trade safe out there!